Thus, employees who are paid hourly, and not by salary, are almost always entitled to overtime pay, but salaried employees still must meet other considerations before being considered and "exempt" employee who does not get overtime pay. For example, assume that a nonexempt employee is paid $10 per hour, plus $.50 per hour shift differential. For that work week, the regular rate is $10.50 per hour, time and one half of which is $15.75. In other circumstances, however, the FLSA arithmetic is more complicated. Assume, for example, a $10 per hour employee who also receives an "extra" $500 per year as longevity pay.

That $500 per year is considered compensation for work and is part of the employee's regular rate of pay. The difficult question is how the $500 should be allocated to each hour actually worked by the employee; by how much per hour the longevity pay bonus increases this employee's regular rate. The answer is that the $500 has to be allocated on a pro rata basis among "all" the hours the employee actually worked during the period when the bonus applied (since the longevity pay was "earned" for "all" the hours the employee worked). Since the longevity pay bonus covered a year's worth of work, it would be allocated among all the hours the employee actually worked in the year to which the bonus applied. This, of course, makes it impossible to determine how much to allocate per hour until the total hours worked by the employee over the entire year is known. Therefore, at the end of the year, the $500 should be allocated to all the employee's work hours, and then the employee's FLSA overtime pay recomputed for each work week when FLSA overtime was worked using the adjusted regular rate.

The employer should then tender the employee the "increase" in FLSA overtime pay attributed to the regular rate adjustment. Of course, for many employers this can be a daunting administrative task, and it may be questioned whether the cost of performing these computations will exceed the value of the exercise. How an employee is paid depends on if the employee is non-exempt or exempt from minimum wage and/or overtime pay. The minimum wage and overtime pay are based on the hours worked each workweek and not by the number of hours worked each day or by the number of days worked regardless of the length of the pay period. Any employee can be paid on any basis – salary, hourly, commission, piece-rate, flat rate – as long as they receive minimum wage for all hours worked in the pay period, and as long as overtime is paid when required.

Overtime is usually required at time and one-half the regular rate of pay for hours worked in excess of 40 in a week. There is a provision in the overtime regulations that "exempts" employees whose primary duty is administrative, executive, or professional work from overtime requirements. One of the requirements for each of these exemptions is that the employees are paid on a salary basis. Employees must meet the definitions in the law in order to be classified as exempt.

For more information on these definitions, see "Wisconsin Hours of Work and Overtime Law," part of the Labor Standards Information Series. The rules are the same for a large corporation or a small mom-and-pop business. C. Wage and Hour Act nor the federal Fair Labor Standards Act limit the amount of hours that an employee 18 years of age or older can be required to work either by the day, week, or number of days in a row. There are no limitations on how many hours an adult employee can be required to work regardless whether they are a salaried-exempt employee or a non-exempt employee.

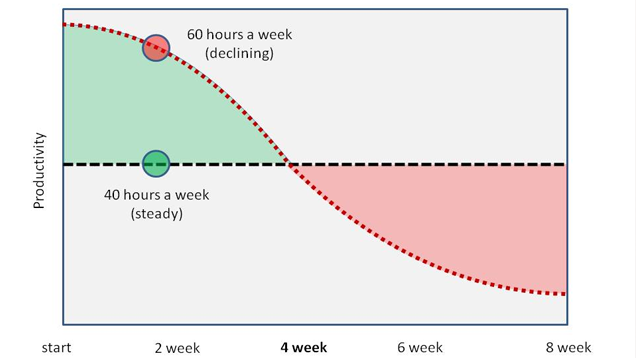

The employer is only required to pay time and one-half overtime pay based on an employee's regular rate of pay for all hours worked in excess of 40 in a workweek to its non-exempt employees. There is no limit on the number of hours the adult employee may be required to work. The effective hourly wages of in-name-only managers were no lower than wages of other employees when controlling for employee characteristics. Thus, in-name-only managers' base salaries rose to make up for their loss or absence of overtime pay. This suggests that legislation that incorporates more such salaried workers into the nonexempt work force might somewhat restrain their hours of work without increasing employers' labor costs or wage payments to the workers.

Previous research showed that U.S. employers eventually adjust base salaries downward or upward to accommodate the adding or removing of the overtime pay premium, at least in the longer run. Importantly, employees are likely to wind up with fewer hours and higher income because employers' adjustments are likely to be incomplete. Thus, the net result of the new proposed regulation for affected workers would likely be shorter average work hours at the same if not higher take home pay.

Currently low-wage workers who are paid a salary and work overtime do not have the same protections as workers who are at the same earnings level but paid on an hourly basis. Specifically, under Fair Labor Standards Act overtime work protections, all hourly workers must be paid at least "time-and-a-half," or 1.5 times their regular pay rate, for each hour of work per week beyond 40 hours. Only salaried workers making below $455 per week (equivalent to $23,660 per year) qualify for the same automatic protections.

Salaried workers making $455 a week or more only have the right to earn overtime pay if their duties are determined to be nonexempt duties. This means that employees who make as little as $23,660 per year may have no limit on their weekly work hours nor earn any pay for working beyond the standard 40-hour workweek. The vast majority of workers in Ohio are covered under federal and state laws that require employers to pay overtime wages at time and a half for hours worked over 40 hours in a designated work week. This includes wages, commissions, performance-based bonuses, and shift differentials that your employer pays you. Rather, wages, duties and occupations decipher whether one can gain overtime pay.

Generally, any employee that makes a yearly salary of less than $23,600 can be awarded overtime pay. Likewise, non-management employees performing manual labor or repair, secretarial, kitchen or clerical work are usually permitted overtime pay. With several exceptions, all hourly paid employees should be entitled to overtime. Except for those who travel regularly, most commission-based workers can be awarded overtime. Salaried employees that earn less than $455 per week are allotted overtime. Salaried employees that earn more than $455 per workweek can receive overtime unless their job duties earn them exemption.

This usually includes executive, professional, administrative, outside sales or computer-related occupations. Under the FLSA, employers are required to pay non-exempt workers the minimum wage or more for every hour worked. Workers who work more than 40 hours per week are entitled to receive overtime pay at a rate of one-and-one-half times their regular hourly rates. While non-exempt, statutory employees in New Jersey are entitled to receive overtime pay for the hours that they work above 40 in a workweek, exempt workers are not entitled to the overtime premium. While the Fair Labor Standards Act and New Jersey's labor laws regulate the rules concerning worker pay, little guidance is provided for the number of hours an exempt worker can be required to work during the workweek. An attorney at Swartz Swidler can review your job duties to determine whether you have been properly classified as an exempt employee or if you have been misclassified and are entitled to overtime pay.

Keep in mind that, under the FLSA, the overtime exemptions, minimum salary threshold, and duties tests only apply to white-collar jobs—and not blue-collar workers or police officers, firefighters, or first responders. According to the FLSA, exempt workers are those excluded from any overtime pay while nonexempt workers may accept minimum wages as well as overtime payments. Most of the nonexempt workers include hourly employees while the salaried employees are exempt. The employer is prohibited from labeling employees as exempt at will or to avoid paying overtime.

To meet the criteria for exempt status, the employee must have met the FLSA's job and wage-related requirements. They can then access payment on salary basis in which case, they qualify for overtime pay if worked. Being paid a salary does not exempt an employee from the minimum wage and/or overtime pay requirements. If an employee is paid a salary and is not paid time and one-half overtime pay for hours worked in excess of 40 in a workweek, then a determination must be made as to if the employee is a salaried-exempt employee or not. The main categories to be a salaried-exempt employee are for executive employees, administrative employees, and professional employees who meet certain requirements.

One of the general requirements is that the salaried-exempt employee must be paid a guaranteed salary of at least $684 a workweek , which would also be the promised rate of pay for the employee. It then does not matter how many hours the salaried-exempt employee works in a workweek as the guaranteed salary is pay for all hours worked in a workweek regardless of the number of hours worked. For more details on the requirements for an employee to be a salaried-exempt employee, please review the Code of Federal Regulations 541, which the N.C. I paid my employee for 43 hours of wages during the last workweek.

Eight of those hours were paid as sick leave, as the employee was out ill for one day. The required overtime pay is 1.5 times the hourly rate for hours worked in excess of 40 in a workweek. Overtime is calculated based on hours actually worked, and your employee worked only 35 hours during the workweek. Unless a policy, contract or collective bargaining agreement states otherwise, you needn´t count sick leave, vacation time, holidays, or other paid time during which the employee did not actually work. Under the Fair Labor Standards Act , non-exempt workers are entitled to overtime pay at the rate of 1.5 times their hourly rate for all hours worked in excess of 40 hours per week. Flex pay is a type of fixed weekly compensation that is sometimes available to employees who work a varying number of hours each week.

Typically, some weeks will require more than 40 hours, and other weeks will require less than 40. Because certain conditions must be met, it is important to consult with an attorney before offering an employee flex pay. To classify an employee as exempt, the worker must meet three tests.

Under the salary test, employers are required to pay exempt workers a minimum weekly salary regardless of the number of hours worked in a week. Employers may not dock an employee's pay for working under 40 hours a week. However, the employers are also not required to pay overtime for hours their exempt employees work beyond 40 during a week.

Before Jan. 1, 2020, the minimum salary that employers had to pay exempt workers was $455 per week. $7.25 per hour with overtime pay required after 8 hours worked in a day or 40 hours in a week. Puerto Rico applies a variable minimum wage that differs between industries. Further, employers covered by the federal wage and hour law, the FLSA, are required to pay the higher federal minimum wage. If employers are not covered by the FLSA, a minimum wage of $5.08 will apply.

ThePuerto Rico Department of Labor and Human Resourceswebsite may have more helpful information on Puerto Rico's wage and labor laws. The FLSA does not require that nonexempt employees be paid hourly. Salaried nonexempt employees are still entitled to FLSA overtime pay if, when and to the extent that they actually work more than 40 hours in a work week. FLSA overtime pay is time and one-half of the employee's regular rate of pay. When a nonexempt employee is paid by a salary, the amount of the salary must be converted to its hourly equivalent to determine the regular rate of pay (time and one-half of which is the employee's FLSA overtime rate of pay). The Fair Labor Standards Act requires employers to pay overtime wages to nonexempt employees for each hour worked in excess of 40 hours within a single workweek.

Salary 40 Hours A Week These overtime wages must be paid at a rate of at least one and a half times the employee's regular pay rate. Minnesota establishes two minimum wage rates lower than the federal minimum. For employers with annual receipts of $500,000 or more, the minimum wage is $10.08 an hour. For those with receipts of less than that amount, the minimum wage is $8.21 per hour.

A temporary, training wage of $8.42 per hour is also allowed in specific circumstances. Federal wage and overtime laws supersede the state's laws for qualified employees. TheMinnesota Department of Labor and Industrywebsite may have additional specific information on wage laws in the state.

Nearly half of the states have a rate equal to the federal rate of $7.25, while several other states and D.C. The higher rates set by these states will apply to most workers. However, the minimum wage and overtime pay requirements below do NOT apply toexempt employees, farmworkers, or public sector employees, as defined by both federal and state laws.

My employer paid me for 43 hours of wages during the last workweek. Eight of those hours were paid as sick leave, as I was out ill for one day. Overtime is calculated based on hours actually worked, and in this scenario you worked only 35 hours during the workweek. Unless a policy, contract or collective bargaining agreement states otherwise, you do not get overtime pay if you used sick leave, vacation time, holidays, or other paid time and did not actually work. Under the Fair Labor Standards Act , most employees must be paid at least minimum wage for regular work hours and receive overtime pay when total weekly hours reach more than 40. Florida follows the overtime rules of the FLSA, time and one half regular pay rate for all hours worked in excess of 40 in a regular work week.

Overtime can usually be calculated by taking your regular rate of pay and multiplying it by 1.5. $11.75 per hour for employers with 2 or more employees, with a yearly increase. The minimum wage is also set to match the federal minimum should it exceed Vermont's. Overtime pay is required for time worked over 40 hours, but state law exempts a variety of industries, including retailers, hotels, and restaurants, from the overtime rule. TheVermont Department of Laborwebsite may have additional specific information on wage laws in the state.

Support for this can be found in a natural experiment created in 1999, when California extended overtime coverage to white-collar workers with salaries between $250 and $460 per week. By implication, this suggests that employers' labor costs would not rise, on balance, and thus hiring would not be impaired, and newly covered workers would no longer have unpaid extra work hours. In sum, there is little long-term risk that boosting the overtime pay premium threshold would undermine job creation or hurt those workers intended to be helped. Simply putting an employee on salary will not negate any overtime payments for extra hours worked. Granted, tracking overtime with salaried employees can be a bit more challenging than with with hourly workers.

Salaried employees may be exempt from overtime if they make a certain amount or perform specific duties that are not recognized as eligible for overtime pay. For nonexempt employees with a fixed salary, there's one additional step. First, you would determine the employee's regular rate of pay by dividing their weekly salary by the number of hours that salary is meant to cover—and then multiplying that number by 1.5. According to the FLSA, employers must pay non-exempt employees no less than time and one half their regular pay rate for each hour over 40 in a workweek. If a non-exempt employee isn't paid by the hour, the hourly rate can be calculatedby dividing the total compensation earned by the total hours worked. Vacation, holidays or sick days should not be included when performing these calculations unless the employee worked on those days.

California requires a minimum wage of $14.00 for employers with 26 employees or more. Employers with less than 25 employees are required to pay $13.00. Overtime pay of time-and-a-half is required for hours worked over 8 in a day, 40 in a week, and for the first 8 hours of the seventh day worked in a week. Double pay is required for any hours worked over 12 in a day or in excess of eight hours on any seventh day of a workweek.

TheCalifornia Department of Industrial Relationswebsite may have additional specific information on wage laws in the state. The Department of Labor requires employers to pay overtime to non-exempt salaried employees at least 1.5 times their regular hourly rate for all hours worked over the 40 hours during a workweek. Any work time exceeding 40 hours a week must be compensated at one and a half times the employee's hourly rate. However, most employees do not enjoy their right to receive the proper overtime payments. That is mostly as a result of lack of clarity on the employer's part on which workers are exempt from overtime laws and those who are not. This means that independent contractors do not have to be paid time and a half for working overtime.

As a result, employers have a significant economic incentive to misclassify employees as independent contractors, and often do in an attempt to avoid paying overtime wages. Additionally, employers must pay social security, Medicare, and unemployment taxes on wages of employees. Independent contractors are individually responsible for paying income tax and self-employment taxes. Most employees who work more than 40 hours in a 7-day workweek must be paid overtime. Overtime pay must be at least 1.5 times the employee's regular hourly rate. Other overtime rates, like double time pay are not required under Washington state law, with the exception of certain public works projects.

All nonexempt workers who fall under the rules established by the U.S. Fair Labor Standards Act must receive a minimum wage of not less than $7.25 per hour, as of 2017. If these workers put in more than 40 hours in any given workweek, they must also receive overtime pay.